Welcome back to Flexibility Is Freedom!

I hope you're all having an awesome summer and getting lots of sun (& vitamin D).

This month's featured image is my Mom's vegetable garden, where we're currently harvesting lots and lots of tomatoes (hothouse and cherry tomatoes).

Here in my home province of Ontario, we are also celebrating the end of our emergency phase, as it relates to COVID-19, and moving into the recovery phase.

In a similar way, July 2020 was a recovery month for my passive income business, as revenue bounced back to May 2020 levels, up from the bottoms of June 2020.

In this month's income report, I'll talk about the projects that I've been working on to both increase and diversify my income, following the Amazon Associates rate cut in April.

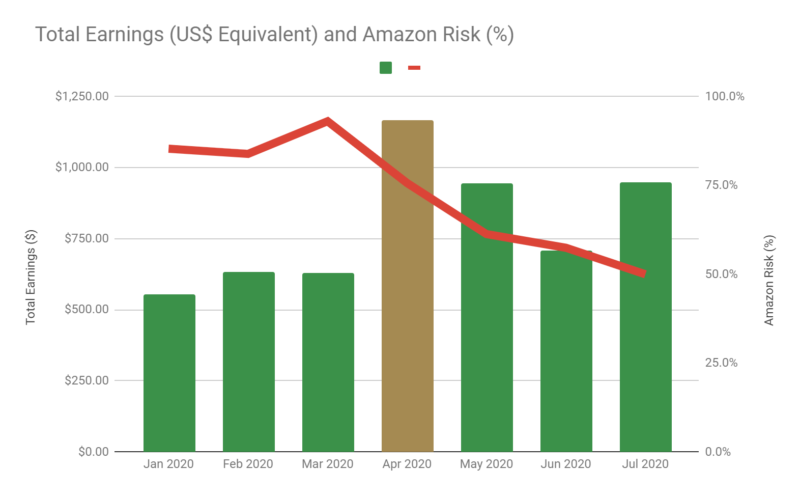

*Percentage of revenue from Amazon Associates programs

Here's a chart of Revenue and Amazon Risk (which I really liked from last month's post):

As you can see, revenue has recovered to May 2020 levels, just $50 shy of $1,000.

However, I've managed to reduce my Amazon exposure to 50% this month, down from 80-90% levels in Q1 and 60-75% levels in Q2. This meets my previously set goal of 50% and I'd like to reduce my Amazon exposure even further to 25-30% by the end of 2020.

In the last 3 months, I've been busy executing Part 1 of my post-Amazongeddon strategy (as outlined under "Evaluating Alternative Retailers" in my April 2020 post).

In a nutshell, I've been redirecting my traffic to alternative retailers like Sephora, Ulta Beauty, and direct-to-brand, where possible, while taking into consideration the effective Earnings Per Click of each merchant (which requires some time for data collection).

(side note: most of my original content on scar products did not have alternative retailers, at least, none that had an affiliate program. This really highlights the importance of having a diversity of merchants to work with for any given product.)

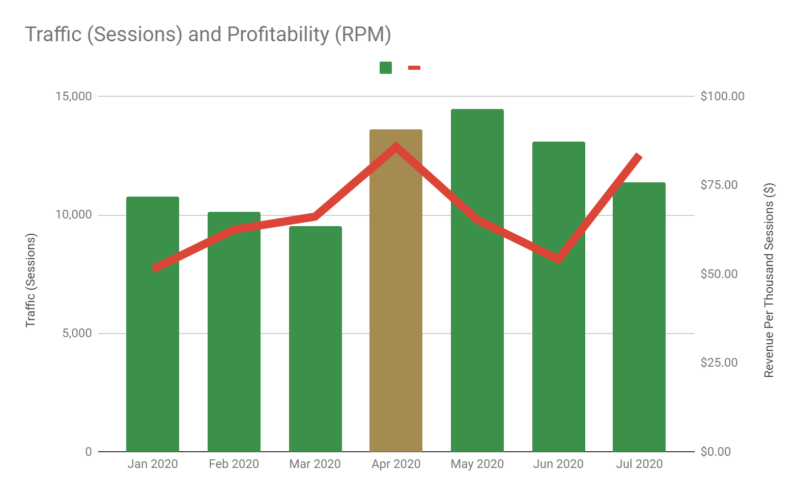

Next up, here's a chart of Sessions and Revenue Per Thousand Sessions:

So here's where things get interesting:

Last month, I talked about how most of my content portfolio became very "low-profitable" following the Amazon Associates rate cut (not unprofitable, but yielding only 1% on low traffic and low conversion rate keywords).

That's why I decided to remove almost all of this content in mid-June (but only after examining each post individually based on Google Search Console and Google Analytics data; I also added 301 redirects to preserve any "link juice" these posts may have received).

I then focused on my top-performing posts, in many cases, completely rewriting them, for better SEO (ranking & traffic), better CRO (user experience & conversions), and better monetization opportunities (merchant diversity & effective EPC).

I believe these two steps (a. removing low profitability content, b. doubling down on higher profitability content) led to the paradoxical traffic decline and revenue increase in July 2020.

I did have a few more ideas that I wanted to discuss, but none of them require a full section at this point in time. Here are some of them:

1. Continuous Content Optimization

2. Private Affiliate Programs

3. Social Media & Content Cross-Pollination

That's it for this month. In August, I plan to take a bit more of a break from my business, enjoy the summer weather here, and work on my personal health & relationships more.

Overall, as I stated in my H1 review last month, I still feel very optimistic about my business, all things considered. While there will always be temporary setbacks like the Amazon rate cut, or another Google algo change, or a worldwide pandemic, if you can build a level of psychological resilience and willingness to adopt change, in a relatively quick manner, then I think you're not going to be worried about the next obstacle in your way.

The other thing is that you have to look at how the world is changing and what kinds of industries, technologies, and skills, are going to be in demand in the near future. And from my perspective, I think the world is now accelerating towards the digital/e-commerce economy, even more so with the pandemic situation, then ever before. We're going to see more and more business models pop up, that leverage the increasingly digital consumer and increasingly technology-driven business and supply chain. Whether that's food delivery, driver-less taxis (no risk of COVID there), or the next Tik-Tok, I think this new decade will be one of massive innovation and creative destruction.

Until next month,

Tom