A warm welcome back to Flexibility Is Freedom!

This last month closed out a very turbulent and tumultuous H1 for my passive income business (although I suppose you can say that about every business in the world now).

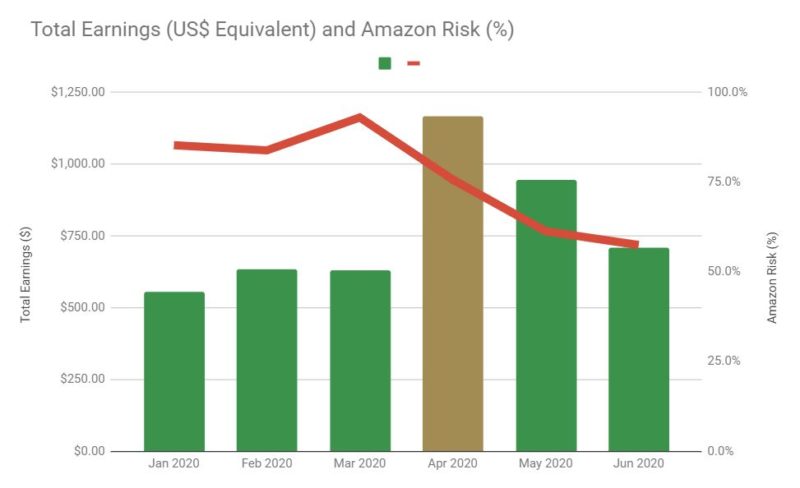

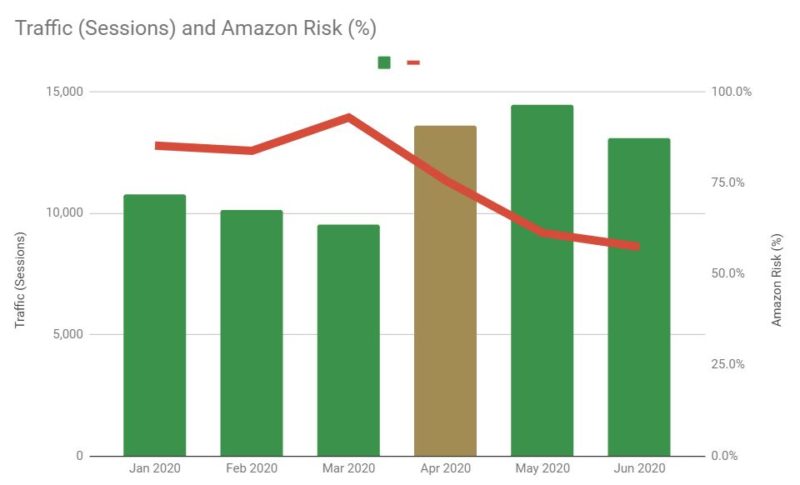

Here's a quick summary of H1 business performance in a nutshell:

Here's a quick discussion of these results:

Overall, it's not been all bad. In the last 6 months, I've managed to grow organic traffic significantly, collect data on conversion rates, outsource backlink acquisitions, and begin the process of diversifying from Amazon Associates (my goal is 50% or lower).

I mean, as the saying goes, "you gotta roll with the punches, kid".

By the way, I also made a video about the Amazon Associates rate cut and a 5-step plan to overcome this new challenge and rebuild my affiliate website (better & stronger!):

In the rest of this income report, I'll talk about H1 performance and my plan going forward.

*Percentage of revenue from Amazon Associates programs

In June 2020, revenue declined by 25% MoM, partly due to a dip in traffic (-10%) but mainly because I've switched out most of my Amazon affiliate links for alternative merchants and now I'm working to optimize those clicks (i.e. collect data on clicks and conversions to determine which merchants offer the best EPC; it might even be Amazon in some cases).

Sessions also declined this month, partly due to the absence of any link acquisitions in June 2020, but also because I've made some dramatic changes to my content strategy in response to the (permanently) lower profitability of Amazon Associates. I'll discuss these changes now.

When I first started my website, TheDermDetective.com, back in November 2018, I wanted to focus on content about acne scars and related skincare topics and use my personal experience and medical research to help my readers overcome their skincare challenges.

As a new website, I started by targeting low competition and low volume keywords in the scar niche, such as "[scar product A] vs [scar product B]" and "[scar product A] reviews". For the most part, I was successful in capturing the "vs" keywords and ranking in the top 5 for the "review" keywords.

In retrospect, however, I realized that I had focused almost exclusively on the SEO (traffic) strategy without sufficient consideration of the CRO (conversion) and profitability (monetization) strategy.

Here's what I mean:

Under the new Amazon commission rate structure, most of my previous content on scar products have now become 1% yielding offers (since most fall under Health & Household).

For example:

As you can see, I don't earn very much per sale on these items, even the high-priced ones at $200.

To earn a respectable income, you would need to pump a ton of traffic to Amazon to offset the low commission rate (1.0% Health & Household, 3.0% Beauty).

Since most of my previous content focused on low competition and low volume keywords, this was a clear mismatch with the profitability of the new Amazon Associates program.

In addition, there are virtually no feasible alternative merchants for most scar products:

In light of these facts (low conversion rates on "vs" and "review" content, low commission rates for health products on Amazon, low dollar price point of most scar products, and the lack of feasible alternative merchants), I have decided to remove all of my existing content on scar products.

I considered just keeping them around but I think it's better to refocus my energy and put it into rebuilding my content portfolio. This time, I'm paying much more attention to the conversion rate and profitability of my content during the keyword research and content creation stages.

For example, I prefer to win "best" keywords over "vs" and "review" due to the higher conversion rate and ability to swap out underperforming products (i.e. I'm not tied to a particular product or brand, as with the "vs" and "review" keywords).

In addition, I'm focused on finding products and categories that have multiple merchants (for more diversity of monetization routes) and strong EPC performance (the combination of both commission rate and conversion rates). This will require further testing so that I can make data-informed decisions on which merchants will yield the best return for my content.

Overall, taking both the good and the bad into consideration, I would say that H1 2020 has been a successful period:

In H2 2020, I will continue to create more conversion-optimized content and explore additional monetization routes including display ads (which usually have a minimum threshold for traffic; e.g. Mediavine, an advertising network, requires 50,000+ sessions per month for new publishers) and product or service offerings.

My best wishes to you and stay healthy!

-Tom